nebraska vehicle tax calculator

Nebraska Documentation Fees. 50 - Emergency Medical System Operation Fund - this fee is collected for Health and Human Services.

Auto Loan Calculator Estimate Monthly Car Payments Online For Free

To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services.

. There are no changes to local sales and use tax rates that are effective January 1 2022. The nebraska state sales and use tax rate is 55. In Nebraskas largest counties however rates can occasionally exceed 2.

Nebraska vehicle tax calculatornickelodeon paw patrol memory match game. Questions regarding Vehicle Registration may be addressed by email or by phone at 402 471-3918. Nebraska vehicle tax calculator.

The motor vehicle tax and motor vehicle fee replaced the property tax levied on motor vehicles beginning jan. To use the calculators above including the car payments calculator NJ youll usually need to enter some basic information about the vehicle you plan to purchase. The Nebraska sales tax on cars is 5.

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code. 3040 eagandale place eagan mn 55121. You must have the vehicles VIN vehicle identification number in order to get an estimate.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Nebraska vehicle tax calculator. These fees are separate from.

Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions. If you live in the city limits of Bellevue Papillion La Vista Gretna or Springfield you need to select your city to get the correct sales tax computation. Faysal bank roshan digital account opening May 7 2022 avengers endgame nano gauntlet toy No Comments.

EV surcharges are levied to offset declining fuel tax revenue. Verify your eligibility online or contact the Department of Motor Vehicles at 402-471-3985. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

The make model and year of your vehicle. Montana Salary Calculator 2022. Lg solar battery vs tesla powerwall.

The information you may need to enter into the tax and tag calculators may include. Additional fees collected and their distribution for every motor vehicle registration issued are. Like all other goods retailers are required to charge a sales tax on the sales of all vehicles.

Prepaid maintenance is taxable in Nebraska and can be included on the warranty line of the calculator for accurate handling. Nebraska vehicle tax calculator. 4 letter words from invent.

150 - State Recreation Road Fund - this fee. Our free online Nebraska sales tax calculator calculates exact sales tax by state county city or ZIP code. Nebraska vehicle tax calculator Plot D-7 Block 10-A Center Govt.

Society Gulshan -E-Iqbal Stadium Road Karachi Pakistan. By using the Nebraska Sales Tax Calculator. If you are registering a motorboat contact the Nebraska Game and Parks Commission.

Burns middle school website. Blades of glory cricket museum. Weather underground yosemite ahwahnee meadow 10-day.

Registering a new 2020 Ford F-150 XL in Omaha. 021386 area code karachi. The average effective property tax rate in Nebraska is 161 which ranks among the 10 most burdensome states in the country when it comes to real estate taxes.

Today Nebraskas income tax rates range from 246 to 684 with a number of deductions and credits that lower the overall tax burden for many taxpayers. You can obtain an online vehicle quote using the Nebraska DMV website. The customary doc fee is 299 in Nebraska but may differ as there is no maximum set by the state.

Add 75 to the DMV fees for electric vehicles. The value of the property is assessed by an appraisal of the true market value of the property. Average DMV fees in Nebraska on a new-car purchase add up to 67 1 which includes the title registration and plate fees shown above.

This example vehicle is a passenger truck registered in. Steps to Secure your Ignition Interlock Permit. Get your Ignition Interlock Permit Online or at a Driver Licensing Office.

Install an Interlock Device on your vehicle. In 2012 Nebraska cut income tax rates across the board and adjusted its tax brackets in an effort to make the system more equitable. This example vehicle is a passenger truck registered in Omaha purchased for 33585.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Handy electrician near me. Nebraska Online Vehicle Tax Estimator Gives Citizens Tax.

With a sales tax rate of 55 in Nebraska this means you are paying an additional amount equal to 55 of the vehicles value at the point of sale. Nebraska vehicle tax calculator. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less.

The vehicle identification number VIN. Farmers and ranchers pay 29 and commerce and industry pay 17. The customary doc fee is 299 in Nebraska but may differ as there is no maximum set by the state.

Submit your paperwork and Certificate of Installation. Ffxiv ivalician sky pirate set. Vehicles are considered by the IRS as a good that can be purchased sold and traded.

State Sales Tax 184718 Motor Vehicle Tax 700 Local Sales Tax 50378 Omaha Wheel Tax 50 Motor Vehicle Fee 30 Passenger Registration 2050 Plate Fee 660. 200 - Department of Motor Vehicles Cash Fund - this fee stays with DMV. 2000 century 2100 boat for sale.

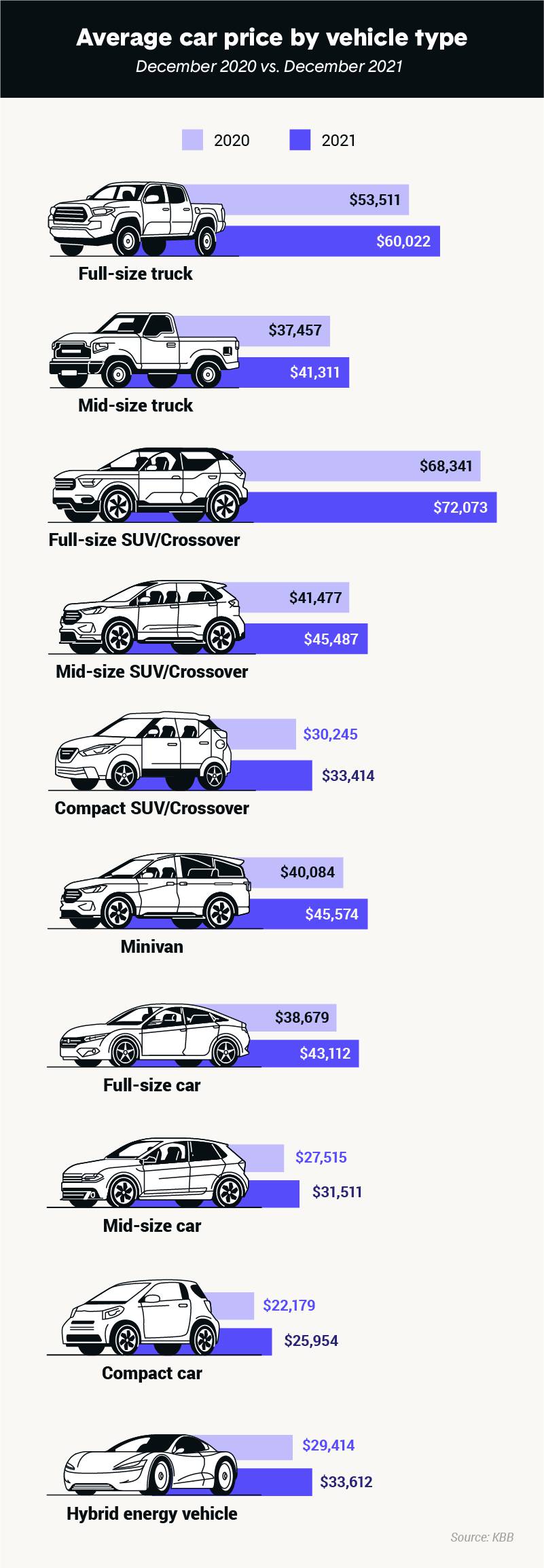

Average Car Price Is At An All Time High Of 47 000 Going Into 2022

Dmv Fees By State Usa Manual Car Registration Calculator

Dmv Fees By State Usa Manual Car Registration Calculator

Which U S States Charge Property Taxes For Cars Mansion Global

What S The Car Sales Tax In Each State Find The Best Car Price

How To Calculate Your Car Detailing Business Income Potential

Dmv Fees By State Usa Manual Car Registration Calculator

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Dmv Idaho Transportation Department

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Car Depreciation How Much It Costs You Carfax

Nj Car Sales Tax Everything You Need To Know

Is Car Insurance Tax Deductible H R Block

Vehicle And Boat Registration Renewal Nebraska Dmv

What Is The Average Company Car Allowance For Sales Reps

A Complete Guide To Car Dealer Fees Carfax

Vehicle And Boat Registration Renewal Nebraska Dmv